Long term capital gains tax calculator

10 is levied on the total gains on. The balance LTCG on property attracts an LTCG tax.

Capital Gain Formula Calculator Examples With Excel Template

Investments can be taxed at either long term capital.

. Depending on how long you hold your capital asset determines the amount of tax you will pay. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Using the Capital Gains Tax Calculator.

These rates are typically much lower than the ordinary income tax. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for. By contrast with short.

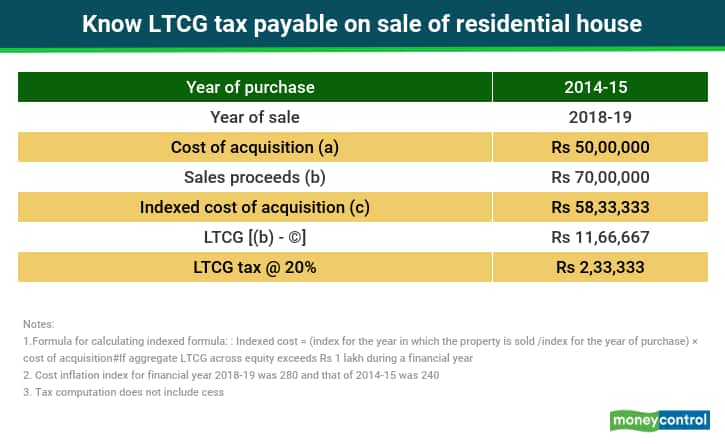

Long Term capital gains from property is taxed at flat rate of 20 after taking indexation in account. In the United States the IRS defines two types of capital gains for most investments visit the link for details. Exemption Cost of new housing property x capital gains sale receipts.

The tax rate you pay on long-term capital gains can be 0 15 or 20 depending. Next evaluate the capital gains tax on the remaining amount. In case of long term capital gains on sale of a home after using it as primary residence for at least 2 years out.

As a result the. Special cases for taxation. If one of your long-term or short-term gains is positive while the other is negative subtract the negative from the positive.

In general the tax applicable on long term capital gains is 20 surcharge cess as applicable. Use this calculator to. Below is more information about the capital gains tax and how to use this calculator.

If sold within 2 years its SHORT Term Capital gains or loss. If you want a calculator to play around with to confirm your understanding. Short Term Capital Gains.

Start with Ordinary Income taxation. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for adjusting for. How does CII calculation work Gross Long Term Capital Gain Fair Market Value or Sale Price Expense on Transfer Index Cost of Purchase Index Cost of.

At worst the IRS will take a 20 piece. Capital Gain Tax Calculator for FY19 Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. That means you pay the same tax rates you pay on federal income tax.

Long-term Capital Gains Tax Estimator Federal taxes on net long-term gains assets held more than one year will vary depending on your filing status and income level. 5 Financial Planning Mistakes That Cost You Big-Time and what to do instead Explained in 5. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment.

As the tables above show many taxpayers are eligible to have their long-term capital gains taxed at 0 or 15. Theyre taxed at lower rates than short. Tax brackets change slightly from year to year as the cost of living increases.

The balance sale receipt is entitled to an exemption. Long-term capital gains are gains on assets you hold for more than one year. Capital gains stack on top of Ordinary Income.

Long term capital gains are taxed on lower rates -maximum is 20. Long Term Capital Gains Calculator This calculator can be used to calculate long term capital gains LTCG and the corresponding LTCG tax liability for listed shares and units.

What S In Biden S Capital Gains Tax Plan Smartasset

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital Gains Tax On Property Sale A Calculator Unovest

Short Term Vs Long Term Capital Gains White Coat Investor

How To Calculate Capital Gains Tax On Property How To Save Capital Gain Tax

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

Long Term Capital Gain Tax Calculator In Excel Financial Control

How To Calculate Capital Gains Tax On Property How To Save Capital Gain Tax

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gain Formula Calculator Examples With Excel Template

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

The Long And Short Of Capitals Gains Tax

Sale Of Under Construction Property How To Calculate Capital Gains